About Documents

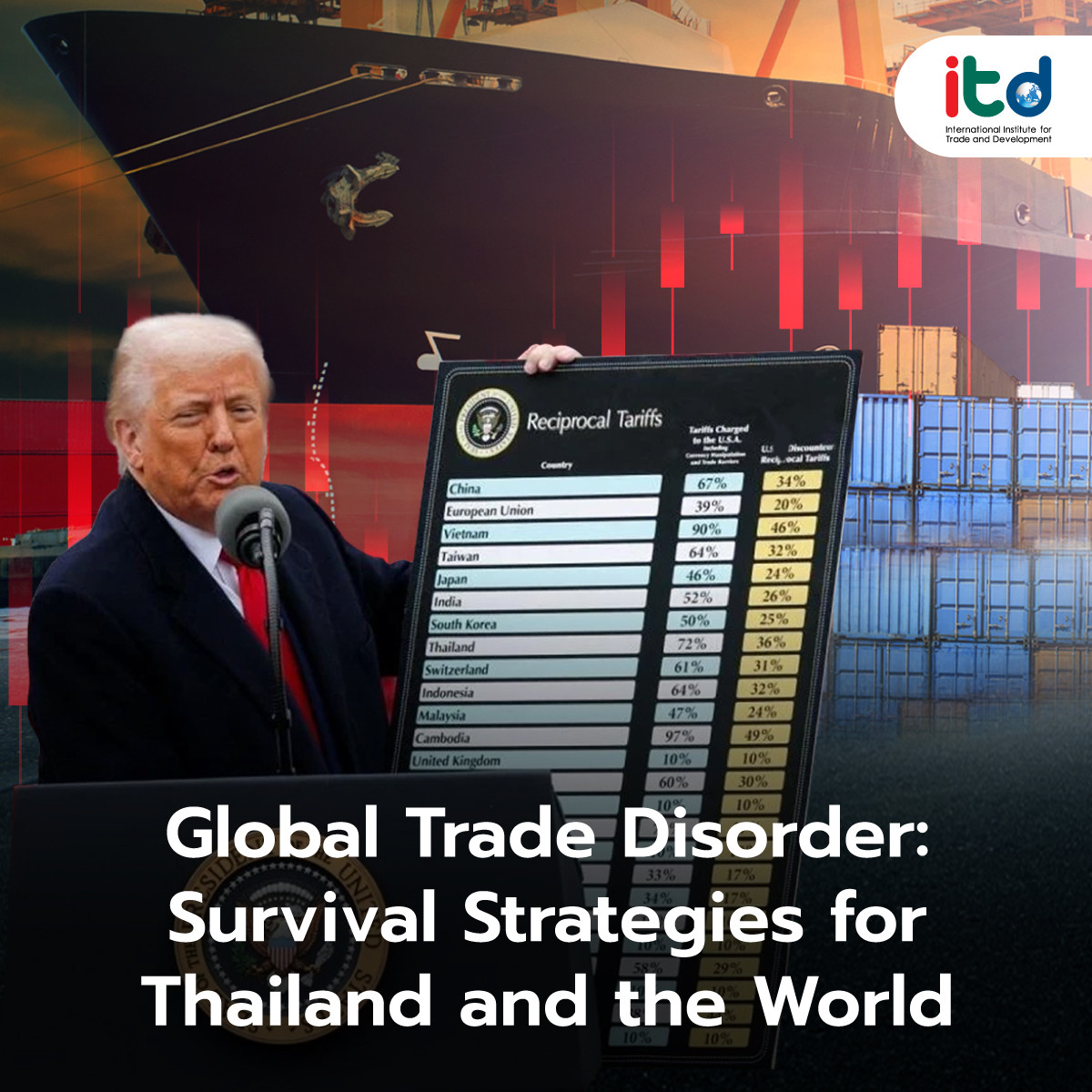

In the first half of 2025, the global economy remains fragile, facing mounting pressures from trade policy uncertainty, financial market volatility, and constrained access to capital. A key contributing factor is the announcement by U.S. President Donald Trump of reciprocal tariff measures targeting numerous countries, both developed and developing. Although a 90-day suspension of enforcement was declared on 8 April 2025, uncertainty remains elevated.

According to UNCTAD Trade and Development Foresights 2025, global growth is projected to slow to 2.3 per cent in 2025—below the 2.5 per cent threshold commonly associated with a global recession. This slowdown particularly affects developing economies, including the ASEAN region, which faces multiple concurrent vulnerabilities, such as high public debt, a deceleration in global trade, and a decline in official development assistance (ODA).

Within ASEAN, some economies—particularly Viet Nam, Indonesia, and the Philippines—continue to post robust growth driven by manufacturing, exports, and domestic consumption. However, the region remains exposed to risks from weakening demand in key trading partners, notably the United States and China. Additionally, ASEAN economies face currency volatility, rising energy costs, and growing household and corporate debt in countries such as Malaysia and Thailand.

UNCTAD data indicate a marked slowdown in exports from developing countries in early 2025, with a notable decline in new orders, signaling contraction in industrial output. Commodity price volatility continues to impact the earnings of countries reliant on agricultural and energy exports.

Thailand’s economic growth remains subdued compared to its regional peers, with a projected GDP growth rate of only 2.2 per cent in 2025. Key structural challenges include limited competitiveness, over-reliance on tourism, and heightened political uncertainty. The country’s export sector also faces challenges from fluctuating logistics costs, unpredictable freight rates, and evolving global trade conditions.

Amidst heightened uncertainty, Thai enterprises face rising financial costs, unstable foreign demand, and policy volatility in tariffs and logistics. Nonetheless, opportunities exist in the expansion of intra-ASEAN trade and the continued growth of digitally deliverable services. Sectors such as software, finance, and professional services continue to exhibit strong export performance across various developing countries.

Short-term strategies for Thai and ASEAN businesses include diversifying export markets by increasing trade with ASEAN members and other developing economies with robust domestic demand, such as India, Africa, and the Middle East. Maximizing the benefits of the RCEP and ASEAN Economic Community trade agreements will be essential to reducing regional tariffs and trade costs, including logistics and customs procedures. Financial strategies should include hedging against exchange rate fluctuations, utilizing financial risk management instruments, and securing low-cost capital from specialized financial institutions.

Long-term strategies require investment in innovation and technology to enhance the value of goods and services, aligning with trends in the digital economy and niche global demand. Emphasis should be placed on exportable digital services—such as e-commerce, fintech, and IT services—which are less reliant on conventional logistics. ASEAN-wide cooperation should focus on establishing regional production and service clusters in areas such as bio-industry, data centers, and technological R&D hubs.

To effectively navigate the current crisis, policy recommendations for the Thai Government include:

- Ensuring political and macroeconomic stability to foster private sector and foreign investor confidence and safeguard the country’s credit rating.

- Accelerating trade negotiations, particularly beyond ASEAN, in regions such as the Middle East, Africa, and Latin America, and facilitating Thai firms’ integration into global supply chains.

- Expanding access to low-interest financing for SMEs and start-ups in high-potential sectors, such as green technology, logistics, and digital content.

- Investing in workforce development in digital, financial, and logistics sectors, along with aligning education systems to industry demands.

- Establishing ASEAN cooperation mechanisms, such as joint industrial development funds, technology sharing initiatives, and integrated infrastructure projects.

While the global economy in early 2025 is marked by heightened uncertainty, both ASEAN and Thailand have opportunities to adapt and pursue growth—provided that strategic investment directions and responsive policies are in place. Thai businesses should seek to leverage regional cooperation, adopt technology and innovation as growth drivers, and maintain close coordination with government to build resilience and enhance long-term competitiveness. The Government’s role as a facilitator and enabler is crucial in transforming crisis into opportunity.

Author:

Ms. Namphueng Tassanaipitukkul

Senior Researcher

International Institute for Trade and Development (Public Organization)

www.itd.or.th

Publication: Bangkok BIZ Newspaper

Section: First Section/World Beat

Volume: 38 Issue: 12886

Date: Wednesday, Apr. 23, 2025

Page: 8 (bottom-left)

Column: “Asean Insight”