About Documents

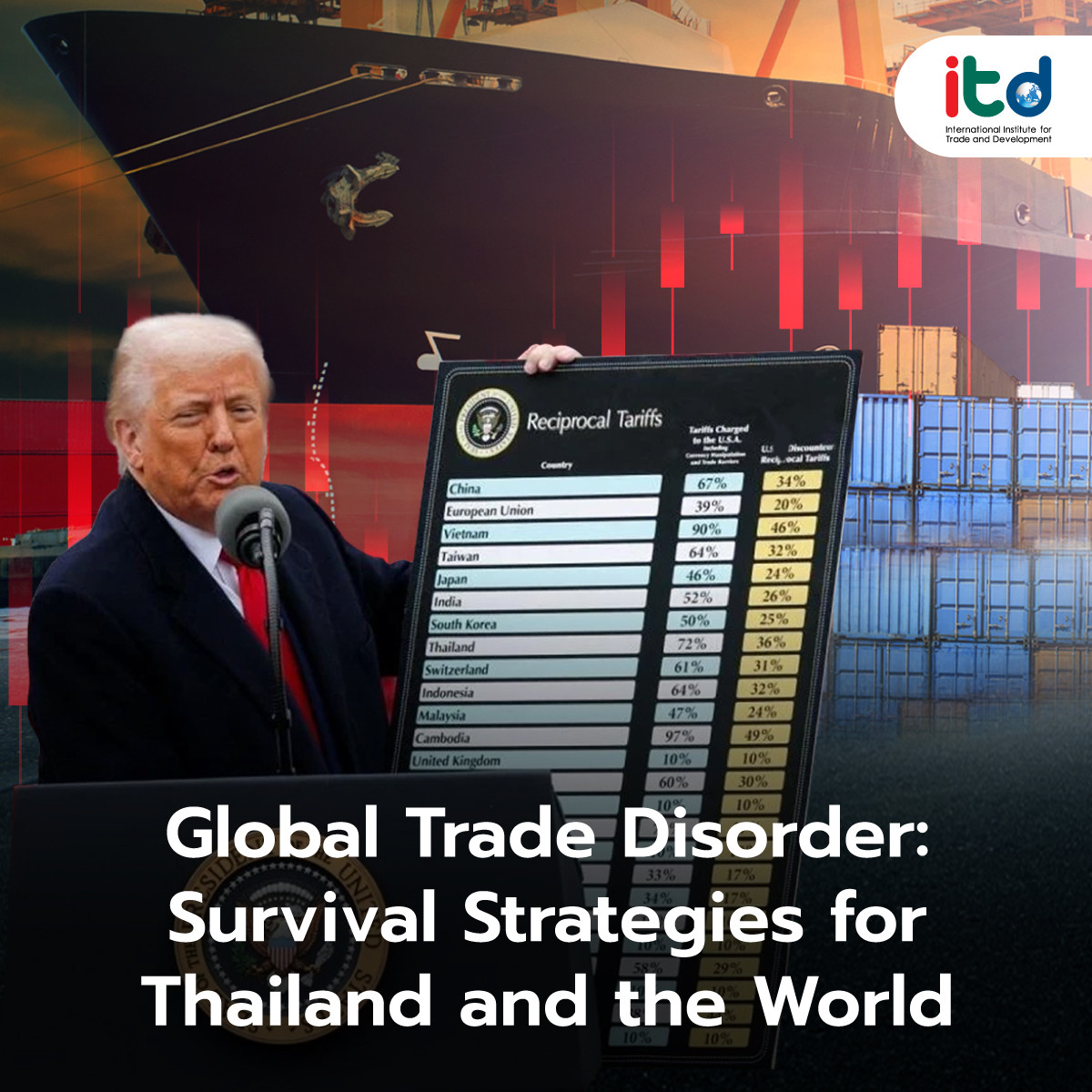

In early April 2025, the global economy entered a state of disorder following U.S. President Donald Trump’s unilateral announcement of the Reciprocal Tariff policy on April 2, 2025. This move triggered a global trade war that has since escalated into conflicts over resources—particularly rare earth elements—and financial instability. There is also growing concern over a potential maritime logistics conflict, as the U.S. Trade Representative (USTR) plans to impose very high port fees on ships manufactured in China for each port call. These developments have raised serious concerns worldwide, including within ASEAN and Thailand, about how to respond and survive this expanding economic conflict.

Several major economies have retaliated by imposing tariffs on U.S. imports. For example, China raised tariffs on American goods up to 125% and banned the export of key rare earth minerals—such as scandium and dysprosium—that are crucial to high-tech industries, including electric vehicles. This has heightened concerns about disruptions to the global supply chain for advanced technologies. The European Union (EU) has also responded by imposing a 25% tariff on both agricultural and industrial imports from the U.S.

The trade conflict has spilled over into the financial sector. U.S. government bonds—long considered the safest assets—have been heavily sold off. Experts around the world anticipate that major bondholders like Japan and China may leverage their positions to pressure President Trump to scale back tariff hikes.

Although the maritime logistics issue has not been widely discussed, it is emerging as a significant risk. The USTR plans to impose port fees ranging from $500,000 to $1.5 million per port call for ships linked to China. This has already led many shipping companies to avoid sending goods to the U.S. to sidestep the high costs.

Currently, a temporary pause in the economic conflict has been observed. The U.S. has suspended the Reciprocal Tariff policy for 90 days, lowered import tariffs for nearly all countries to 10%, and is reviewing the port fee policy for China-related vessels. Additionally, it recently decided to exempt the previously announced 25% import tariff on automobiles.

ASEAN’s Path Forward

- Diplomatic Negotiation

ASEAN countries, being relatively small and lacking strong bargaining power, are best positioned to resolve these issues through constructive dialogue. The recent example of the EU and Vietnam offering a 0% tariff exchange to the U.S. suggests that there are opportunities for ASEAN to negotiate as well. These negotiations may include tariff reductions, increased market access, and addressing non-tariff barriers (NTBs), many of which are outlined in the U.S. National Trade Estimate Report 2025.

Prior to entering negotiations, ASEAN must prepare carefully to respond to any demands from the U.S., considering the potential impact on all stakeholders. Furthermore, ASEAN could consider strengthening trade and investment ties with other partners, such as the EU, middle-power countries, and developing nations, to diversify risk.

- Strengthening Regional Supply Chains and Trade

ASEAN should work to build regional supply chains and increase intra-regional trade and investment to reduce the impact of global trade conflicts and enhance long-term economic resilience. However, challenges remain, including differing standards and regulations among ASEAN members and the need to modernize infrastructure. Closer cooperation is necessary to overcome these obstacles and create a more robust and sustainable regional economy.

In the midst of a turbulent global economic conflict, ASEAN’s commitment to sincere cooperation and constructive negotiation can serve as a guiding path forward. Dialogue based on mutual interest, understanding, and respect will be essential in finding practical and effective solutions. Ultimately, such efforts could lead to a more open, opportunity-rich, and sustainable trade system for all.

Author:

Ms. Warunya Yossai

Senior Researcher

International Institute for Trade and Development (Public Organization)

www.itd.or.th

Publication: Bangkok BIZ Newspaper

Section: First Section/World Beat

Volume: 38 Issue: 12881

Date: Wednesday, Apr. 16, 2025

Page: 8 (bottom)

Column: “Asean Insight”